Bitcoin’s sustained price level above $30,000 has Brough about a noticeable shift in market behavior, particularly among short-term holders.

Short-term holders (STHs), or those who have held Bitcoin for less than 155 days, play a crucial role in market analysis. Their behavior often provides insights into market sentiment and potential price movements.

Typically, they are more reactive to price changes and tend to buy or sell based on recent market trends. This can lead to increased volatility, as their trading activities can cause sharp price swings.

For instance, when short-term holders start to hodl, it can reduce the sell-side pressure in the market, potentially leading to a more stable price environment.

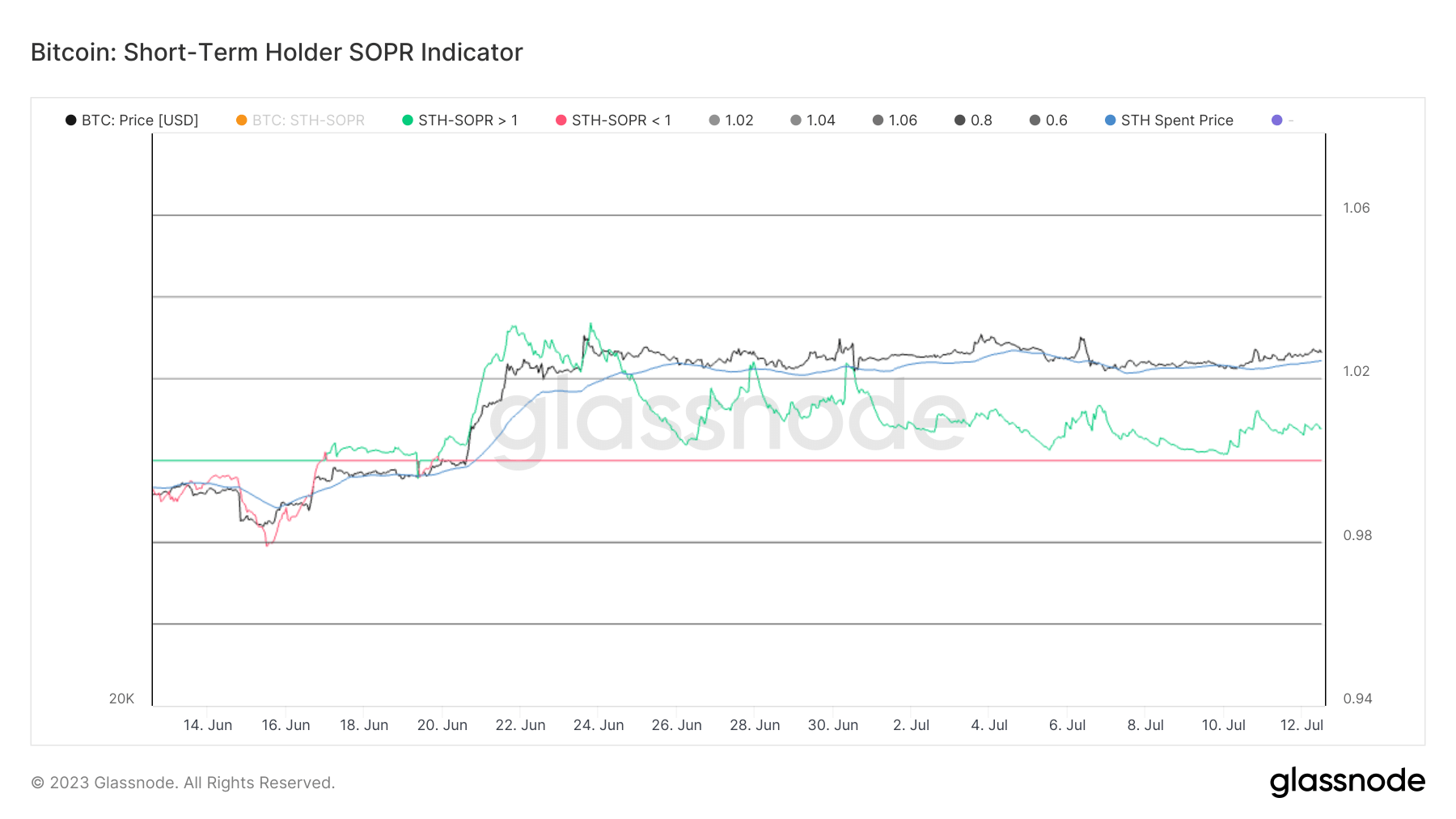

The recent surge in Bitcoin’s price from $26,000 to over $30,000 has put the majority of STHs in profit. This is evident through the Short-Term Holder Spent Output Profit Ratio (STH-SOPR) metric. SOPR is a metric that calculates the profit ratio of coins moved on-chain, provid

We współpracy z: https://cryptoslate.com/are-short-term-holders-hodling/