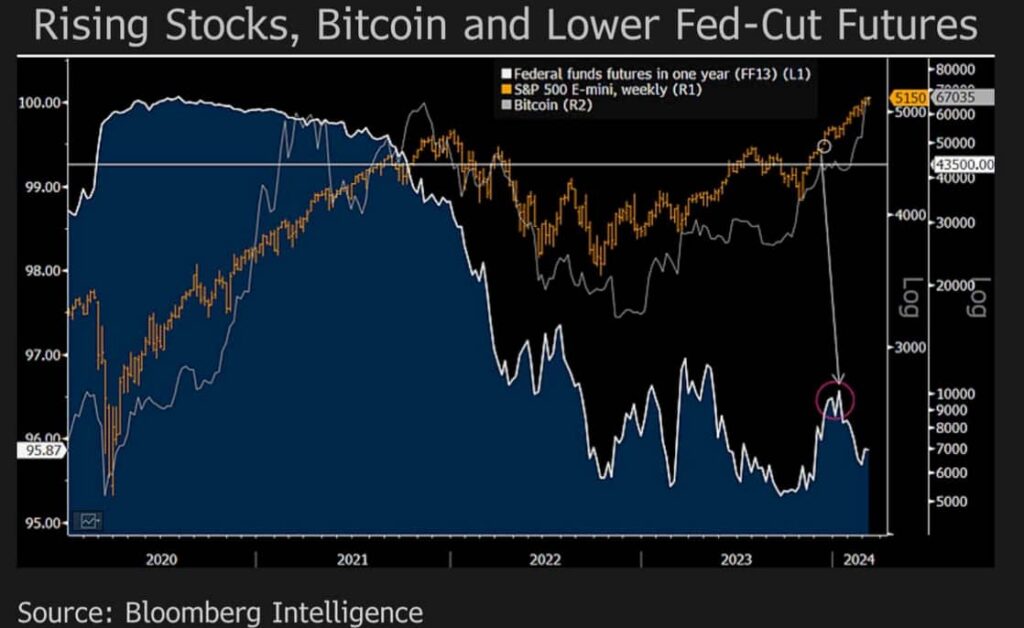

Gold, Bitcoin (BTC), and the S&P 500 peaked at new highs on March 8, quickly retracing to levels seen on the previous day. At the same time, the finance market‘s expectations for lower interest rates increase, creating a strong signal for investors.

In a recent analysis, Bloomberg Intelligence’s Mike McGlone highlighted a crucial relationship between commodity prices, the S&P 500, and Federal Reserve rate-cut expectations amid potential recessionary warnings.

Notably, McGlone’s findings point to a paradoxical situation where the cure for high commodity prices could inadvertently trigger economic downturns. Meanwhile, risk assets reaching new highs would lead to increased inflation metrics. Further, it has potentially triggered renewed hawkish policies by the Federal Reserve.

“A simple technical signal may be better off not working due to deflationary dominoes and recession implications of the S&P 500 falling about 10% from March 7. Our graphic shows the

We współpracy z: https://finbold.com/what-gold-bitcoin-and-sp-500-new-highs-have-in-common/