Former House Representative Ron Paul has presented his stance when it comes to the financial crisis that the U.S. is currently facing. Paul stated that the continued application of quantitative easing (QE), a policy used to increase the money supply, and the decades of almost null interest rates, are what nurtured the current financial crisis the U.S. is facing.

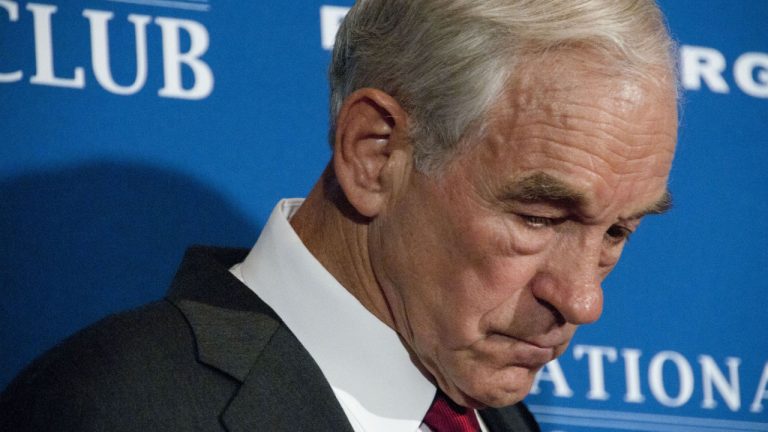

Ron Paul Believes Federal Reserve’s Policies Created Today’s US Financial Crisis

Ron Paul, former representative and presidential candidate, has recently talked about the financial crisis the U.S. is facing. According to him, the policies that the Federal Reserve applied to maintain a welfare state at the cost of creating deficits have created today’s financial hardships for the country.

Paul stated:

Today’s financial hardships stem from the Fed’s decade of near 0% rates and quantitative easing (QE). These created a decade’s worth of uneconomic investments. Every bad idea imaginable received funding.

Paul criticized

We współpracy z: https://news.bitcoin.com/ron-paul-states-federal-reserves-decade-of-near-0-rate-created-todays-financial-crisis/