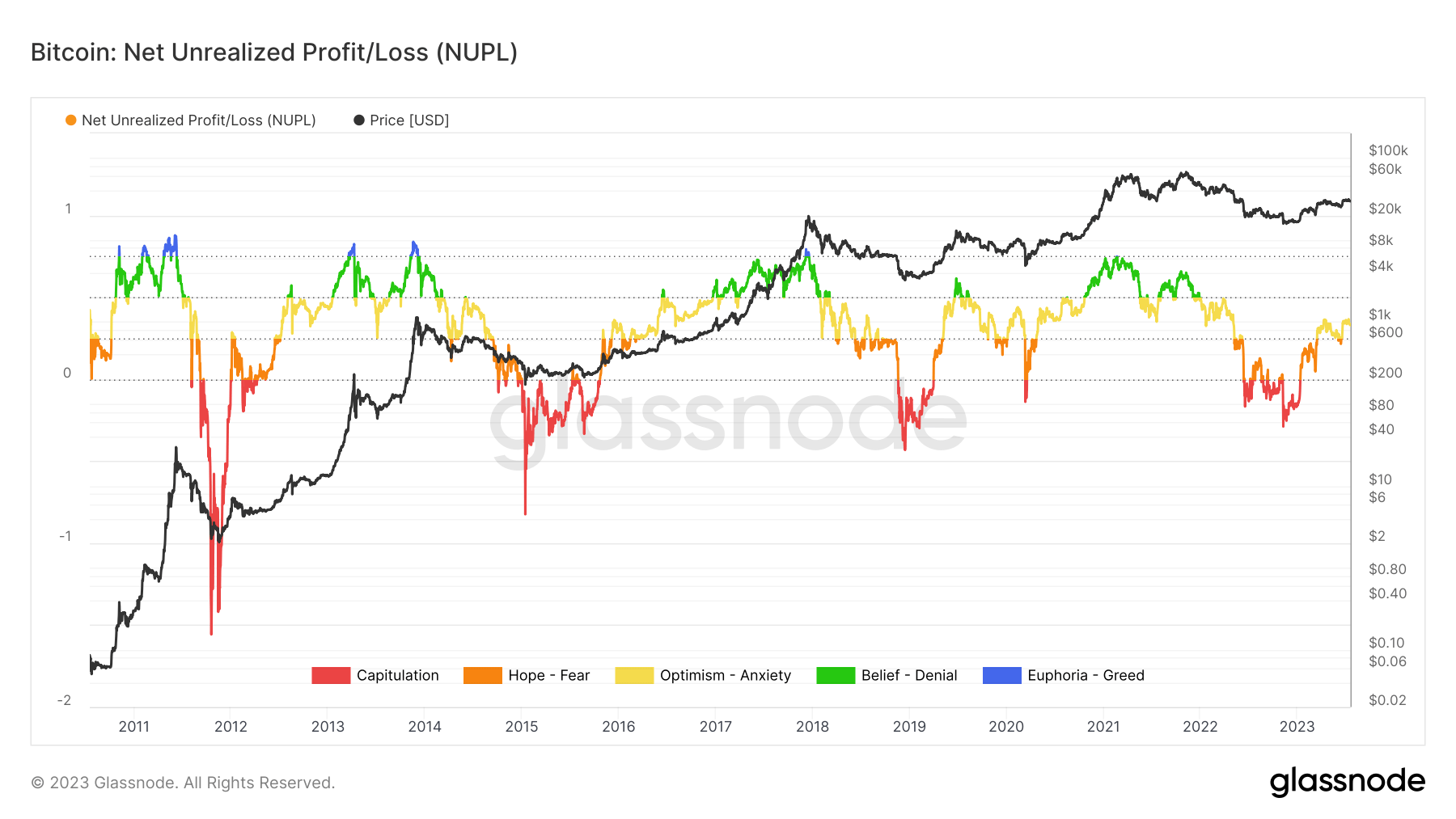

The cryptocurrency market is a complex ecosystem, requiring numerous metrics and indicators to gauge its health and predict future trends. One such metric, the Net Unrealized Profit/Loss (NUPL), provides a nuanced view of market sentiment.

NUPL indicates market sentiment by highlighting the difference between unrealized profit and unrealized loss in the Bitcoin supply.

The ‘unrealized’ aspect refers to gains or losses not actualized by selling the asset. The realized cap measures the value of all coins at the price they last moved, effectively capturing the net investment of coin holders.

NUPL is calculated by subtracting this realized cap from the market cap and dividing the result by the market cap. It’s a valuable tool that offers insights into the collective market sentiment.

A NUPL score below 0 has historically correlated with periods of price capitulation, indicating a bearish market sentiment.

Conversely, a NUPL score higher than 0.75 typically correlates with periods of

We współpracy z: https://cryptoslate.com/rising-unrealized-profits-indicate-a-more-optimistic-bitcoin-market/

![NBP: inflacja osiągnęła cel. Czy na pewno? [Koszyk zakupowy BitHub.pl i aplikacji PanParagon] | Cryptostudent.io - kryptowaluty, blockchain, szkolenie, kurs Bitcoina inflacja bithub XJljiU](https://cryptostudent.s3.eu-central-1.amazonaws.com/wp-content/uploads/2024/04/inflacja-bithub-XJljiU-260x195.jpeg)