Bitcoin’s fall from its all-time high to a low of $15,700 has been one of the most dominating narratives this year. Bitcoin lost 75% of its value since Nov. 10, 2020, and over 65% since the beginning of the year.

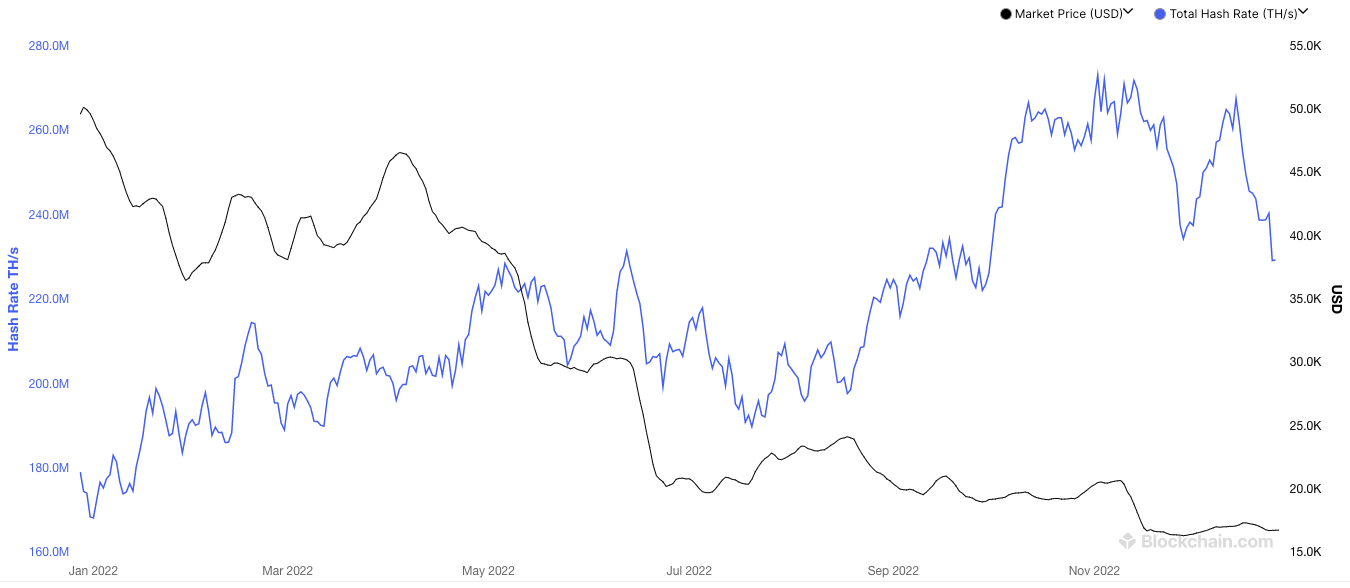

However, a much more remarkable story than Bitcoin’s volatility is the divergence between its price and its hash rate.

Despite losing three-quarters of its value in a year, Bitcoin’s hash rate reached its all-time high of 271.8 EH/s. This divergence between the hash rate and the price is a unique occurrence that hasn’t happened in any of the previous bear markets.

The divergence between Bitcoin’s price and its hash rate in 2022 (Source: Blockchain.com)

The skyrocketing hash rate becomes an even bigger outlier when comparing it to miner revenues. CryptoSlate previously analyzed miner revenue and found that profits continue to decrease even for the largest and most efficient mining operations.

CryptoSlate’s analysis of two popular Bitmain miners paints a bleak pictur

We współpracy z: https://cryptoslate.com/the-antminer-profitability-crisis/