Glassnode data analyzed by CryptoSlate showed significantly greater open interest calls for Bitcoin and Ethereum.

Calls and puts refer to the buying and selling, respectively, of options. These derivative products give holders the right, but not the obligation, to buy or sell the underlying asset at some future point for a predetermined price.

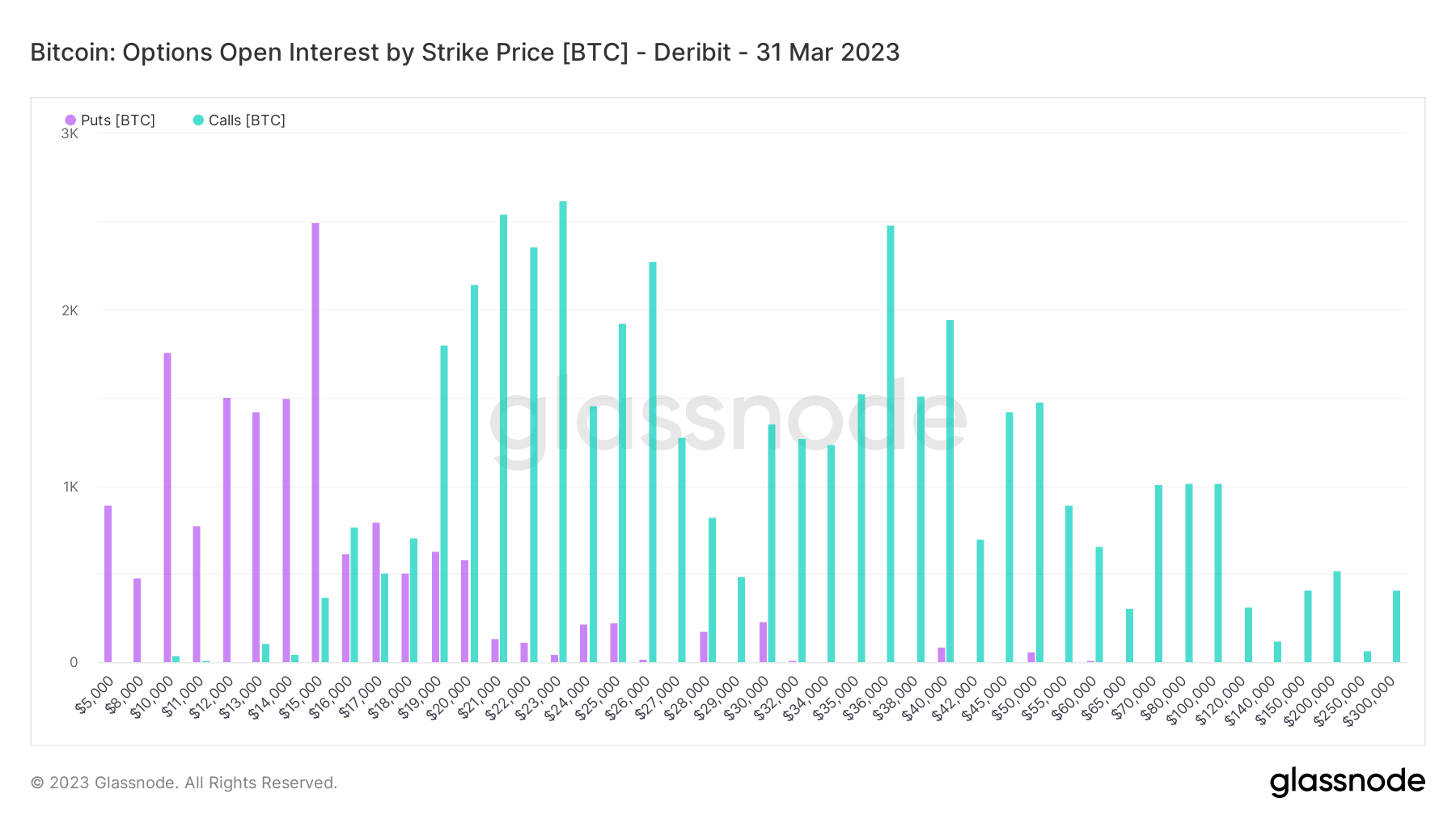

This predetermined price is also called the strike price; in conjunction with the spot price, it determines the option’s “moneyness.”

Calls, where the strike price is lower than the spot price, are “in the money,” as traders can buy the option for less than the market price and sell immediately. Similarly, puts where the strike price is higher than the spot price are “in the money,” as traders can sell the option above the market price.

Being “out of the money” occurs when calls have a strike price above the market price or puts have a strike price lower than the market price.

The spread of calls and puts across different strike

We współpracy z: https://cryptoslate.com/research-8th-january-sentiment-among-bitcoin-and-ethereum-options-traders-flips-bullish/