Bitcoin (BTC) withdrawal patterns on centralized exchanges have changed significantly over the past five years.

CryptoSlate analysis of Glassnode data on BTC’s average withdrawal price on top exchanges like Coinbase, Gemini, Binance, FTX, and Bitfinex reveals an interesting pattern.

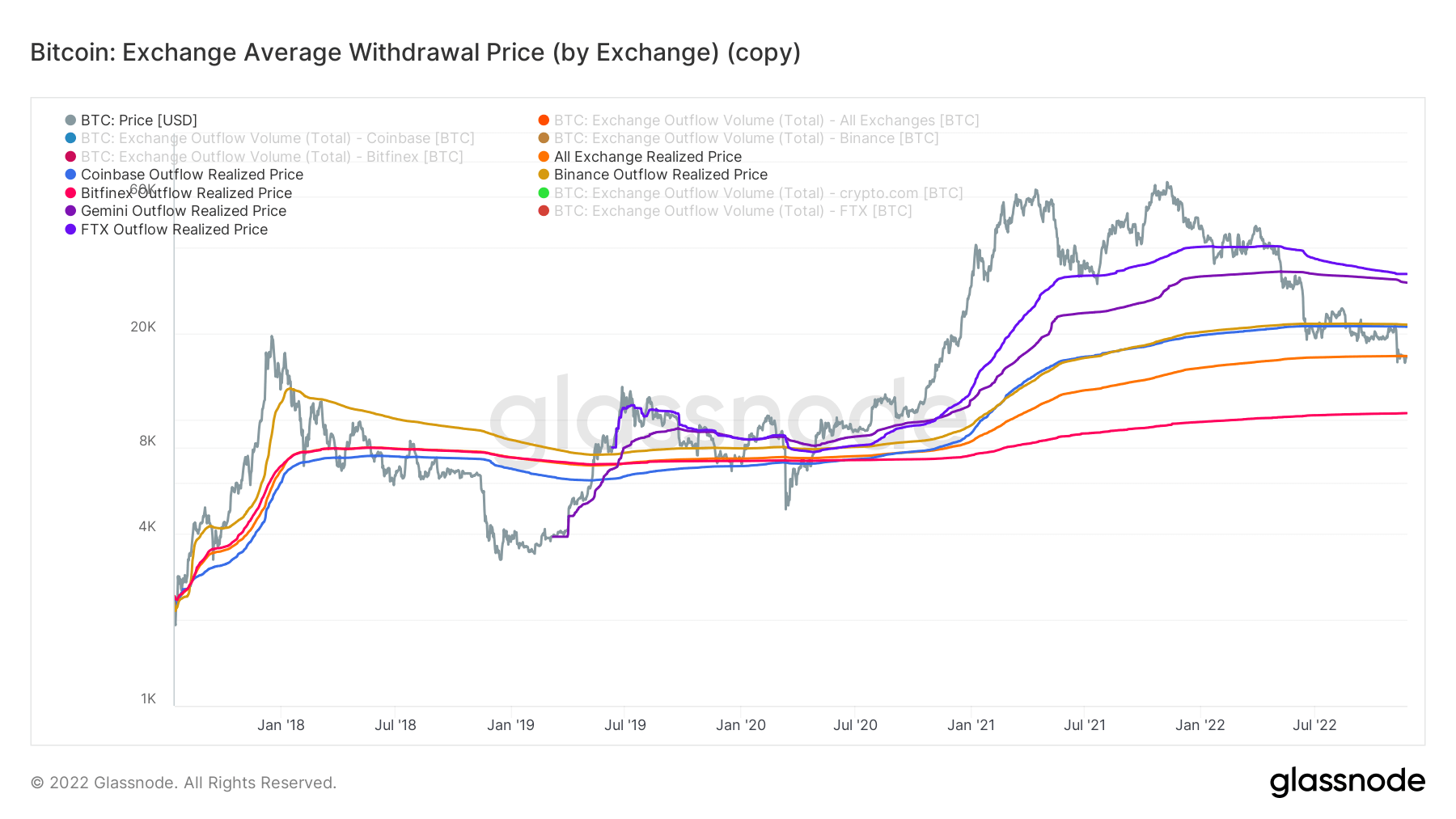

Bitcoin average withdrawal price across exchanges (Source: Glassnode)

The chart above showed that in the early days of crypto adoption, particularly in 2017 when Binance was established, the exchange saw most of the dumb money inflow to crypto.

According to Investopedia, dumb money refers to retail investors who buy primarily because of market hype and the fear of missing out. Usually, this group of investors tends to buy when the price is high or close to the peak.

Because they buy close to the peak, they end up selling or withdrawing when the value of the asset declines. This was evident in the early days of Binance, when most of the withdrawals on the platform occurred after Bitcoin peaked.

This sugges

We współpracy z: https://cryptoslate.com/binance-led-2017-dump-money-bitcoin-investment-ftx-leads-2022-cycle/