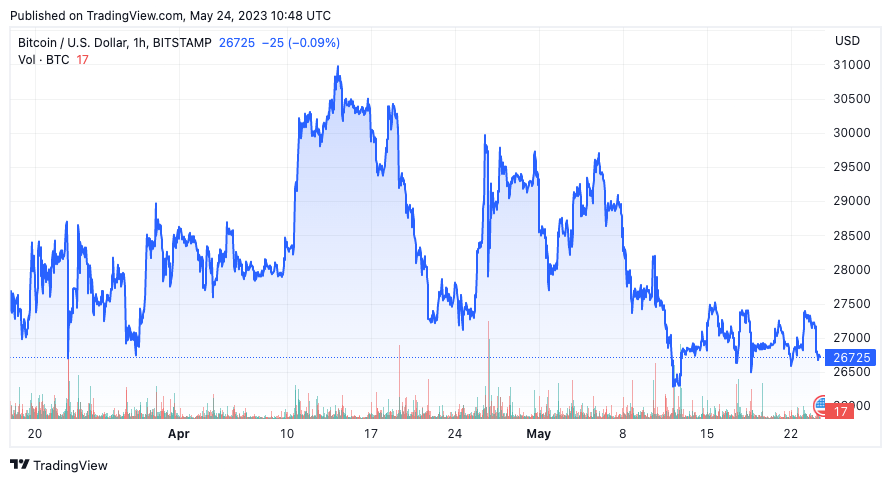

The Bitcoin market has been calm for the better part of May, as prices hover in a relatively stable range between $26,000 and $28,000.

Graph showing Bitcoin’s price from March 17 to May 24 (Source: CryptoSlate BTC)

However, beneath this seemingly tranquil surface, several on-chain metrics indicate potential shifts in market sentiment and investor behavior.

The Spent Output Profit Ratio (SOPR) is a valuable gauge of profitability and losses that the market has incurred. SOPR value greater than 1 suggests that, on average, the coins moved on-chain during that period are being sold at a profit. Conversely, a SOPR value less than 1 implies that coins are, on average, being sold at a loss.

SOPR is trending lower and is gradually approaching the critical threshold of 1. While this may seem like a cause for concern, it is important to note that declining SOPR values may also indicate a market phase where investors are holding their assets, anticipating favorable market conditions or higher

We współpracy z: https://cryptoslate.com/on-chain-indicates-potential-volatility-ahead-for-bitcoin/