Out of all the crypto derivative products, perpetual futures have emerged as a preferred instrument for market speculation. Bitcoin traders use the instrument en masse for risk hedging and capturing funding rate premiums.

Perpetual futures, or perpetual swaps as they’re sometimes referred to, are futures contracts with no expiration date. Those holding perpetual contracts are able to buy or sell the underlying asset at an unspecified point in the future. The price of the contract remains the same as the underlying asset’s spot rate on the contract’s opening date.

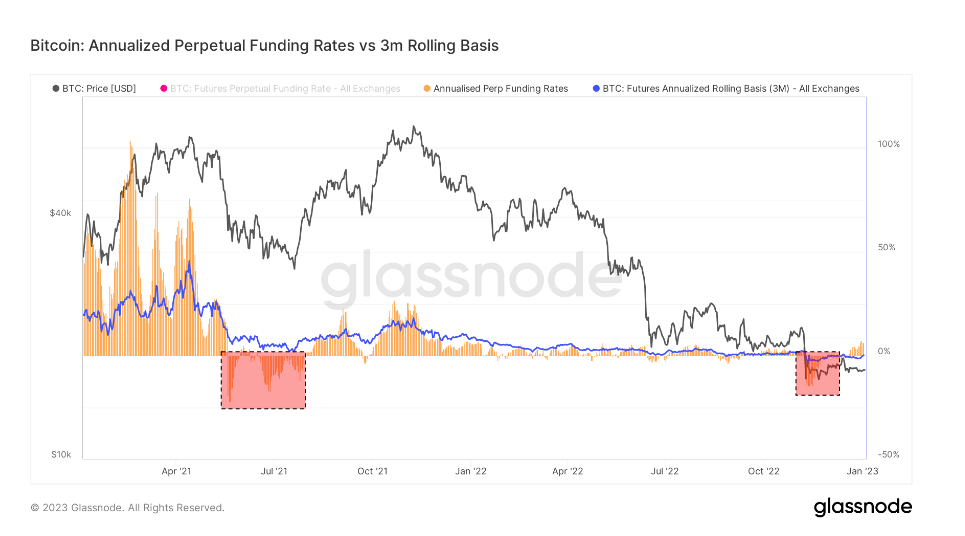

To keep the contract’s price close to the spot price as time goes by, exchanges implement a mechanism called a crypto funding rate. The funding rate is a small percentage of a position’s value that must be paid or received from a counterparty at regular intervals, usually every few hours.

A positive funding rate shows that the price of the perpetual contract is higher than the spot rate, indicating higher demand. Whe

We współpracy z: https://cryptoslate.com/bitcoins-annualized-3-month-futures-basis-show-calm-before-the-storm/