Since Ethereum’s Merge on Sep. 15, 2022, the crypto industry has been abuzz with discussions about its supply dynamics. The Merge marked the network’s transition from a Proof-of-Work (PoW) consensus mechanism to a Proof-of-Stake (PoS), significantly altering its issuance rate. This transition, coupled with the implementation of EIP-1559 in August 2021, has led to oscillations in Ethereum’s supply between inflationary and deflationary states.

In the immediate aftermath of the Merge, Ethereum’s supply exhibited deflationary characteristics. This deflationary trend was primarily driven by the burning mechanism introduced by EIP-1559, which removes a portion of the transaction fees from circulation.

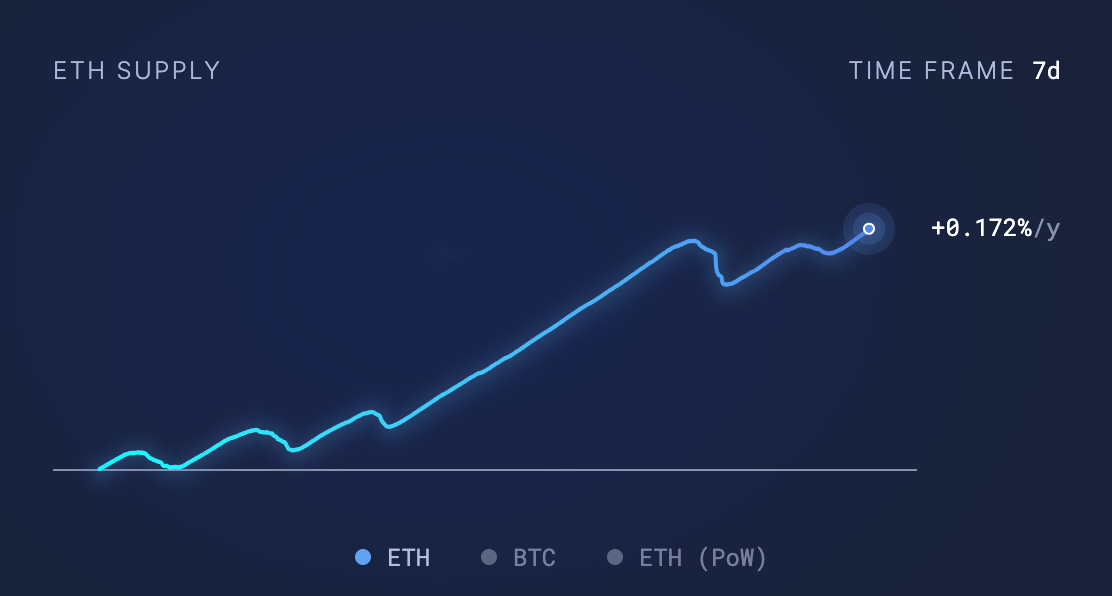

However, observing the supply over shorter time frames shows inflationary tendencies, with an inflation rate of +0.172% observed over a 7-day period.

Graph showing the inflation rate of Ethereum’s supply over 7 days (Source: Ultrasound.Money)

Over a 30-day period, this inflation stand

We współpracy z: https://cryptoslate.com/analyzing-ethereums-inflationary-and-deflationary-supply-trends/